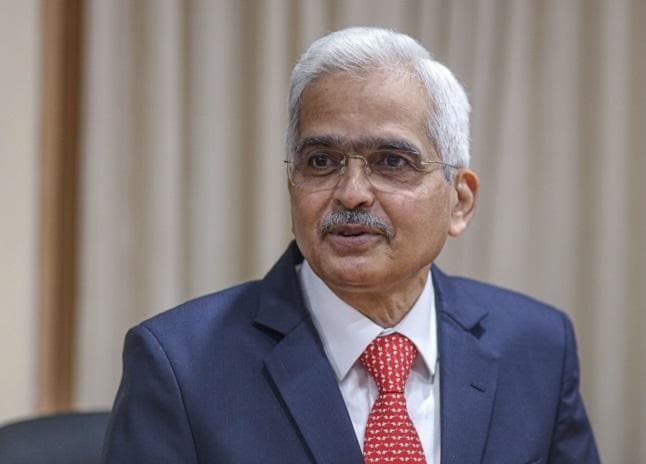

“Inflation is now projected to average 5.1 per cent in 2023-24 compared to 6.7 per cent in 2022-23, but this would still be above the target. The disinflation towards the target rate of 4 per cent is likely to be gradual and protracted,” RBI Governor Shaktikanta Das said, adding that inflation uncertainties had not abated since the April MPC review.

“Our fight against inflation is not yet over. We need to undertake a forward-looking assessment of the evolving inflation-growth outlook and stand ready to act, if situation so warrants. Beyond this and given the prevailing uncertainties, it is difficult to give any definitive forward guidance about our future course of action in a rate tightening cycle,” he said.

Deputy Governor M D Patra said the pause should not be seen as the interest rate cycle having peaked and there could be rate hikes, if needed. “…my vote for maintaining the status quo on the policy rate should be seen as taking a middle stump guard to prepare for a bouncier pitch,” Patra said.

Patra said the pause was only till the next policy and not a prolonged one. “Headline inflation is edging down towards the target, but it is still well above it and the balance of risks suggests that it will go up in coming months before it comes down,” he added.

He also said it would be premature to declare victory at this point of time based on the inflation prints of just a couple of months.

Varma said based on the forecast inflation for 5.1 per cent for 2023-24, the real repo rate is now almost one and half percentage points.

Another external member, Ashima Goyal, also highlighted the issue of real interest rates.

Citing research, Goyal said the inflation targeting regime had contributed to reducing inflation expectations.

She said commitment to such a regime only involves aligning the nominal repo rate with expected inflation. “Such action, together with the greater impact of official communication in emerging markets, is adequate to bring inflation to target as the effect of shocks dies down. It does not require the nominal repo to be kept higher for longer,” Goyal added.