The increase in Reserve Bank of India (RBI) repo rate was necessary to combat inflationary risks, said minutes of the Monetary Policy Committee’s (MPC) September meeting released on Friday.

“The focus should be on being time consistent in aligning inflation with the target. In this context, front-loading of monetary policy actions can keep inflation expectations firmly anchored and balance demand against supply so that core inflation pressures ease,” Michael Patra, deputy governor of the RBI and an internal member of the six-member MPC said in the minutes.

The MPC is of the view that amid all these, the Indian economy presents a picture of resilience with macroeconomic and financial stability. The balance sheet of key stakeholders like corporates and banks remain strong, RBI said.

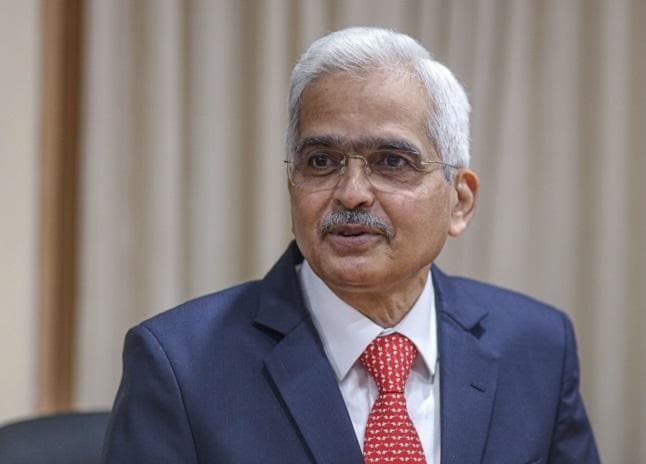

“In an interconnected world, however, the Indian economy is obviously impacted by the unsettled global environment. There are pronounced consequences not only for our domestic inflation and growth dynamics, but also financial markets,” said RBI Governor Shaktikanta Das.

All members except Ashima Goyal voted to increase the repo rate by 50 basis points (bps). Goyal, on the other hand, was pitching for a 35 bps hike.

“Most analysts are arguing for a 50 bps rise just to preserve a spread with US policy rates. This is a fear driven over-reaction. In the past two years spreads of above 300 bps have not brought in debt flows. India has earned enough independence to protect itself from policy errors of other nations.,” said Goyal.

GIPHY App Key not set. Please check settings