India’s economy showed signs of slowing-but-steady growth last month, with businesses holding on to optimism that domestic demand will revive as the peak shopping season approaches.

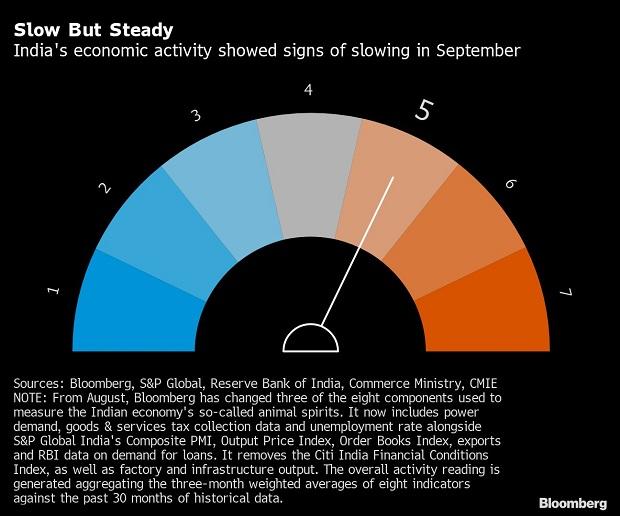

Four of the eight high-frequency indicators tracked by Bloomberg News showed activity eased in September, while two showed improvement and two held steady. Still, the needle on a dial measuring so-called animal spirits was unchanged from a month ago, as the gauge uses the three-month weighted average to smooth out volatility in the single-month readings.

The reading belies expectations of blockbuster retail sales in the run-up to ‘Diwali,’ the festival of lights, which this month will herald India’s peak shopping season.

S&P Global India said weak external demand weighed on overall sales, while the World Bank separately cut India’s growth forecast for the year to March by a full percentage point to 6.5%, citing rising borrowing costs and global risks.

From August, Bloomberg has changed three of the eight indicators to include power demand, consumption tax collection, and unemployment rate, in place of Citi India Financial Conditions Index, factory and infrastructure output. Below are details of the dashboard:

Business Activity

Purchasing managers’ surveys showed activity across services and manufacturing sectors moderated in September due to inflationary pressures. As a result, the composite gauge eased to a six-month low. That said, business confidence remained upbeat, with sentiment at its highest level in over seven-and-a-half years, according to S&P Global.

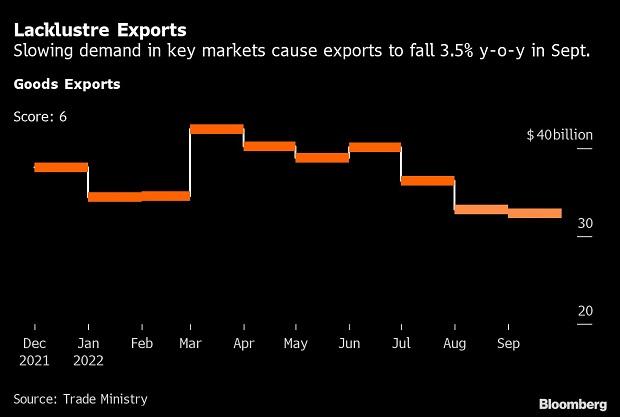

Exports

Exports declined 3.5% from a year ago, preliminary data from the trade ministry showed. That’s the first drop in more than a year, which the government attributed to a demand slowdown in some developed economies.

Consumer Activity

Liquidity in the banking system tightened, but continued to remain in surplus. Demand for bank credit climbed 16.4% as of Sept. 23, the most since October 2013, despite borrowing costs at a three-year high. That trend supported a 11% growth in retail vehicle sales, data from the Federation of Automobile Dealers Associations show. Goods and services tax collections, a measure of consumption in the economy, rose 26% in September from a year ago.

Market Sentiment

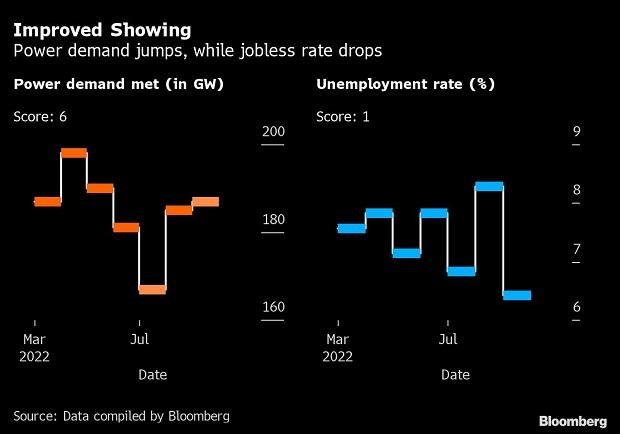

Electricity consumption, a widely used proxy to gauge demand in industrial and manufacturing sectors, showed activity inching up slightly from the previous month. Peak demand met at the end of September jumped to 187 gigawatt from 185 gigawatt a month ago. Ahead of the festival season, unemployment rate dropped to the lowest in more than four years, helped by a strong rise in new jobs, according to data from the Centre for Monitoring Indian Economy Pvt.

GIPHY App Key not set. Please check settings