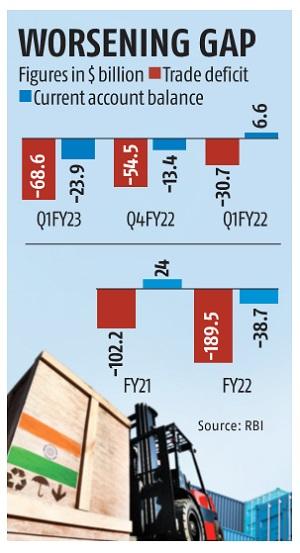

India’s current account deficit (CAD) in April-June was at $23.9 billion, or 2.8 per cent of gross domestic product (GDP), much higher than the $13.4 billion, or 1.5 per cent of GDP, in January-March 2022, the Reserve Bank of India (RBI) said on Thursday.

India had recorded a current account surplus of $6.6 billion, or 0.9 per cent of GDP, in April-June 2021. The CAD for FY22 was 1.2 per cent of GDP, or $38.7 billion. For the first quarter of the current year, it is lower than analysts’ prediction of around 3 per cent of GDP.

“Underlying the current account deficit in Q1:2022-23 was the widening of the merchandise trade deficit to US$ 68.6 billion from US$ 54.5 billion in Q4:2021-22 and an increase in net outgo of investment income payments,” the RBI said on Thursday.

India has faced upward pressure on its import bill in 2022 because Russia’s invasion of Ukraine in late February led to a sharp rise in prices of commodities across the globe.

During April-August, India’s trade deficit rose to $125.22 billion versus $53.78 billion the same time last year. So far in 2022, the rupee has depreciated 9.2 per cent against the dollar.

In the first quarter of the current year, net services receipts increased both on quarter-on-quarter and year-on-year owing to increasing exports of computer and business services, the RBI said.

Services exports registered a growth rate of 35.4 per cent year-on-year, driven by broad-based increase in computer, business, and transportation and travel services, the RBI said.

Private transfer receipts, which represent primarily remittances by Indians employed abroad, clocked $25.6 billion, registering an increase of 22.6 per cent year-on-year.

“While the trade deficit has widened, a lot of support has come from the invisibles account with both software and remittances witnessing higher net inflows of $30.7 billion and $23 billion, respectively,” said Madan Sabnavis, chief economist, Bank of Baroda.

“These were higher than the trailing four quarters and come at a time when the Ukraine war was at its peak,” he said.

The net outgo on the income account, which is a measure of payments of investment income, rose to $9.3 billion in April-June from $7.5 billion a year ago, the RBI said.

In the first quarter of the current fiscal year, India’s net foreign direct investment rose to $13.6 billion from $11.6 billion a year ago.

Net foreign portfolio investment, however, showed an outflow of $14.6 billion as against net inflows worth $400 million in the first quarter of the previous fiscal year.

Net external commercial borrowing recorded an outflow of $3 billion in April-June versus an inflow of $200 million a year ago.

In a separate release, the RBI said at the end of June 2022, India’s external debt was at $617.1 billion, showing a decrease of $2.5 billion over its level at the end of March.

The external debt to GDP ratio declined to 19.4 per cent at June-end 2022 from 19.9 per cent at March-end 2022, the RBI said.

Short-term debt on a residual maturity basis constituted 45.4 per cent of the external debt at the end of June 2022 versus 43.2 per cent at the end of March and accounted for 47.6 per cent of foreign exchange reserves.

Short-term debt is that which matures in a year.

In July, RBI Governor Shaktikanta Das had said much of the outstanding external commercial borrowing was hedged. They were borrowings by public-sector firms that hold assets with a natural hedge.

In April-June 2022, non-resident deposits showed net inflows worth $300 million, sharply lower than the $2.5 billion the same time a year ago.

In July, the RBI announced several relaxations on foreign currency non-resident (bank) deposits in order to attract more overseas capital.

“There was an accretion of US$ 4.6 billion to the foreign exchange reserves (on a BoP basis) in Q1:2022-23 as compared with US$ 31.9 billion in Q1:2021-22,” the RBI said.

As on September 16, 2022, the RBI’s foreign exchange reserves were at a near-two-year low of $545.65 billion.

GIPHY App Key not set. Please check settings