India’s business and consumption activity showed conflicting signs of recovery in July as elevated inflation, rising borrowing costs and fears of a global slowdown weighed on Asia’s third-largest economy.

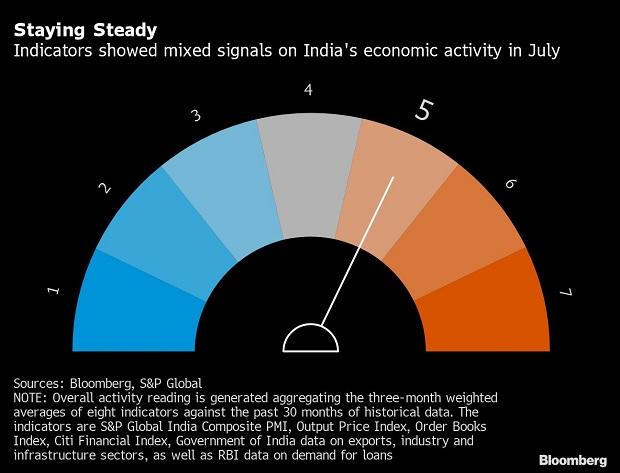

Demand for Indian goods and services softened, a cross-section of high-frequency indicators compiled by Bloomberg News showed. The needle on a dial measuring so-called animal spirits, however, remained steady at 5 last month as the gauge uses a three-month weighted average to smooth out volatility in the single month readings.

The Reserve Bank of India, which has raised interest rates by a total of 140 basis points in three moves this year, has signaled future tightening would be calibrated to ensure there isn’t a massive slowdown in the economy, and sees price pressures moderating from its recent peak. A pulse-check of the economy is due next week, with gross domestic product data for the April-June quarter likely to show a double-digit growth, reflecting demand thanks to a wider reopening from the pandemic.

Below are details of the dashboard. (For an alternative gauge of growth trends, follow Bloomberg Economics’ monthly GDP tracker — a weighted index of 11 indicators.)

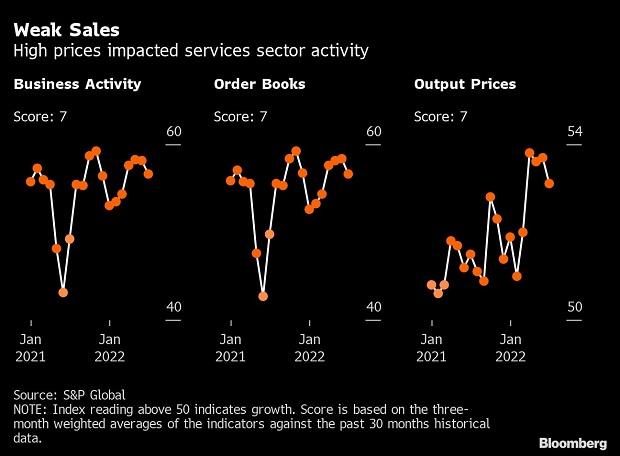

Business Activity

Purchasing managers’ surveys showed India’s services activity in July falling to the lowest level in four months on weaker sales growth and elevated inflation. While domestic demand for Indian services remained steady, international demand worsened, offsetting gains in the manufacturing sector that expanded to the highest level in eight months.

Moderation in business outlook in services pulled down the S&P Global India Composite PMI Index to 56.6 in July, from 58.2 a month earlier.

Exports

Trade deficit widened to a fresh record of almost $30 billion as exports growth slowed to a 17-month low led by weak global demand and a levy on outbound shipments of fuel, which makes up more than 15% of India’s exports.

Imports stayed near the record-high levels due to a weaker rupee, which was one of the worst performing Asian currencies in the last three months. Crude, which comprises about one-third of India’s imports, and coal with an 8% share, primarily contributed to the rise in inbound shipments.

Consumer Activity

Passenger vehicle sales rose for a second-straight month helped by a broad-based recovery in all segments, including two-wheelers. While supply issues due to semiconductor shortage are easing, automakers cautioned that costlier loans could crimp demand for new vehicles.

Bank credit continued to grow despite higher interest rates, rising the most in more than three years to 14.5% at the end of July. Liquidity in the banking system continued to remain in surplus.

Industrial Activity

Among signs of industrial activity, factory output as well as core sector signaled moderation in June as electricity consumption and coal production slowed down with the onset of monsoons. The year-on-year growth in Index of Industrial Production eased to 12.3% from a one-year high in May. The growth of eight key infrastructure industries also dropped to 12.8 from 19.3% in the previous month. Both the data are published with a one-month lag.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

Dear Reader,

Dear Reader,

GIPHY App Key not set. Please check settings